Stotles Guest Blog | NHS budget allocation 2024/25: Uncovering opportunities for suppliers

This blog was written by Dallán Ryan, Research and Content Manager at Stotles, the platform for doing business with the government

Stotles has released fresh insights on how £6.2 billion in NHS funding is allocated across Integrated Care Systems (ICSs) for the 2024/2025 fiscal year. With newly published budgets from 32 of 42 ICSs, suppliers can access valuable information to discover hard-to-find procurement opportunities.

In this blog, we spotlight budget shifts across ICSs, including regions with the largest increases and cuts, and strategies to source IT, construction, and facilities management opportunities across the NHS.

ICSs ranked by 2024/2025 budgets

Every year, Integrated Care Boards (ICBs) publish Capital Resource Plans, outlining their Capital Departmental Expenditure Limit (CDEL), representing their total capital budget for the financial year. These budgets are key for suppliers, as they indicate funded opportunities in areas like infrastructure, equipment, and major NHS projects.

The combined capital budget for 2024/2025 across these ICSs stands at £6.2 billion. Below is a ranking of the top 5 ICSs by their CDEL and their change in allocation compared to last year’s figures.

Download the full report to access detailed summaries of ICS budget allocations and key insights related to budget growth, budget cuts, and tactics to surface IT, Construction & FM opportunities across the NHS.

Despite a 1.14% overall reduction in capital budgets from last year (before adjusting for inflation), 40% of regions have reported increased budgets, opening new opportunities for suppliers to engage. For the remaining 60%, budget cuts indicate a shift in priorities, requiring a more targeted approach from suppliers.

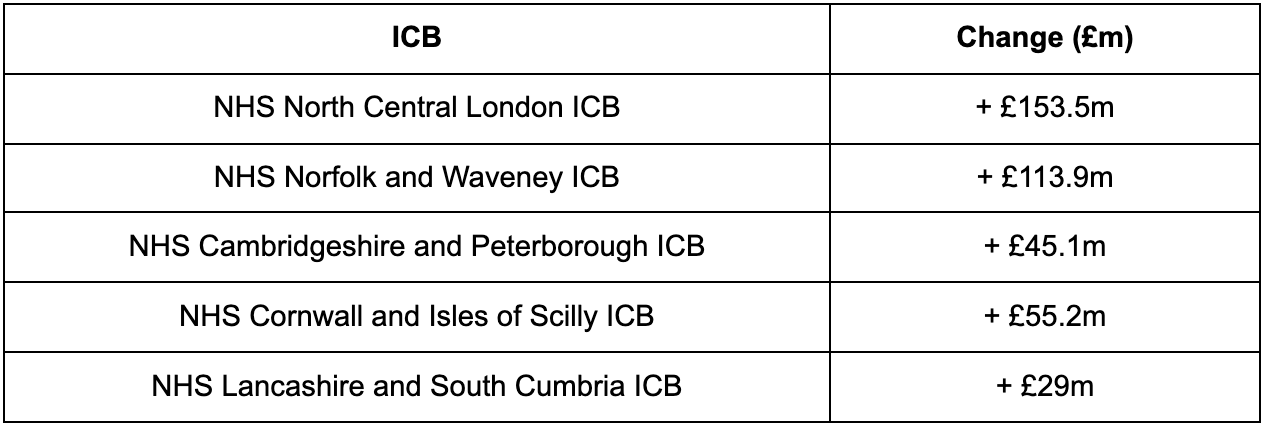

Which ICS budgets have seen the largest budget growth?

Targeting ICSs with growing budgets can unlock substantial opportunities. When capital funding increases, ICBs often invest in infrastructure, technology, and services—areas ripe for supplier engagement.

For example, NHS North Central London ICB, with a 2024/2025 CDEL of £482.5 million, has the largest budget of any ICS this year, marking a significant increase of £153.5 million. Here's how some of their major projects are broken down:

- New builds: £218 million

- IT infrastructure: £64 million

- Equipment: £52 million

IT, construction, and facilities management suppliers will find opportunities across key initiatives like the Moorfields Eye Hospital relocation and the University College London Hospital’s expansion.

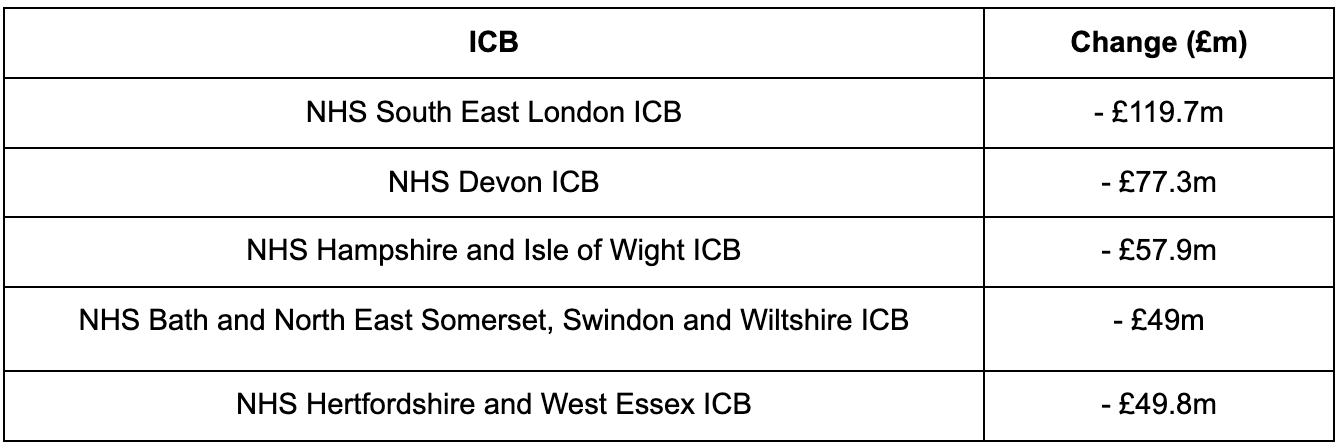

Which ICS budgets have faced the largest budget cuts?

Budget cuts can signal strategic shifts in procurement focus. For 2024/2025, 18 of the 31 ICSs have seen reductions in their CDEL.

For example, NHS South East London ICB has experienced the largest decrease, with its CDEL falling by £119.7 million. Despite this, procurement opportunities remain in critical areas like urgent care capacity and digital transformation.

For IT suppliers, South East London continues to invest in electronic patient record (EPR) systems, with £1.8 million allocated for upgrades at King’s College Hospital.

Unlocking procurement opportunities for suppliers

The 2024/2025 NHS budgets reflect a shifting landscape, offering both challenges and opportunities for suppliers selling into the public sector. At Stotles, we advise suppliers to proactively make the most of opportunities by using search tools, like our Documents feature, to drill into capital plans of specific NHS Trusts and ICBs and filter opportunities by keywords relevant to their business. These tactics empower suppliers to align strategies with procurement needs effectively.

Download the full report to access detailed summaries of ICS budget allocations and key insights related to budget growth, budget cuts, and tactics to surface IT, Construction & FM opportunities across the NHS.

Health and Social Care Programme activities

techUK is helping its members navigate the complex space of digital health in the UK to ensure our NHS and social care sector is prepared for the challenges of the future. We help validate new ideas and build impactful strategies, ultimately ensuring that members are market-ready. Visit the programme page here.

Upcoming events

Latest news and insights

Learn more and get involved

Health and Social Care updates

Sign-up to get the latest updates and opportunities from our Health and Social Care programme.

Authors

Dallán Ryan

Research and Content Manager, Stotles